Biweekly tax withholding calculator

Ohio has a progressive income tax system with six tax brackets. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Calculation Of Federal Employment Taxes Payroll Services

Free Unbiased Reviews Top Picks.

. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. That means that your net pay will be 40568 per year or 3381 per month. Multiply the number of.

Taxes Paid Filed - 100 Guarantee. 51 Agricultural Employers Tax Guide. You then send this money as deposits to the Minnesota Department of.

For example if you received a tax refund eg. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. These figures are exclusive of income tax.

1400 take that refund amount and divide it by the. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Your average tax rate is.

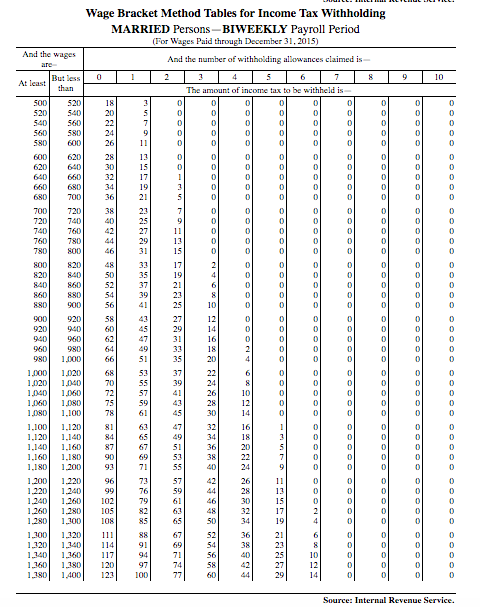

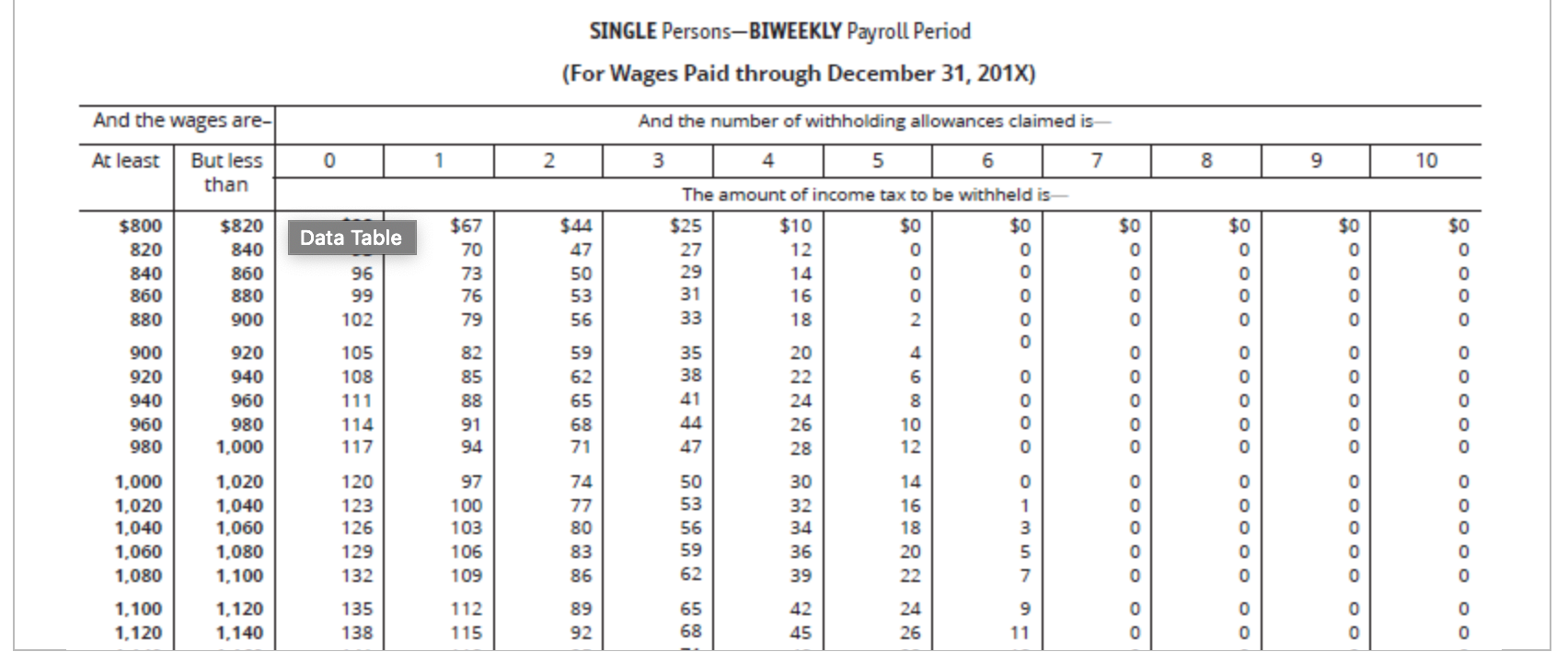

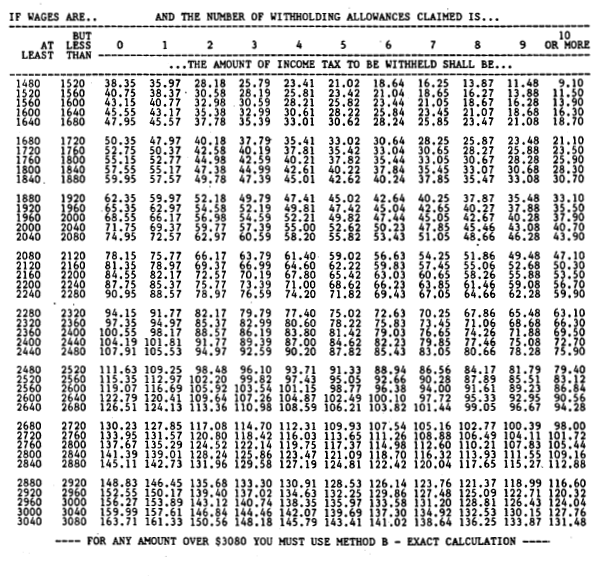

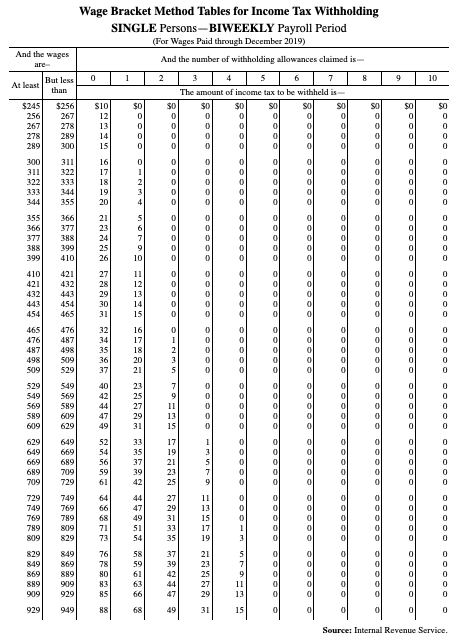

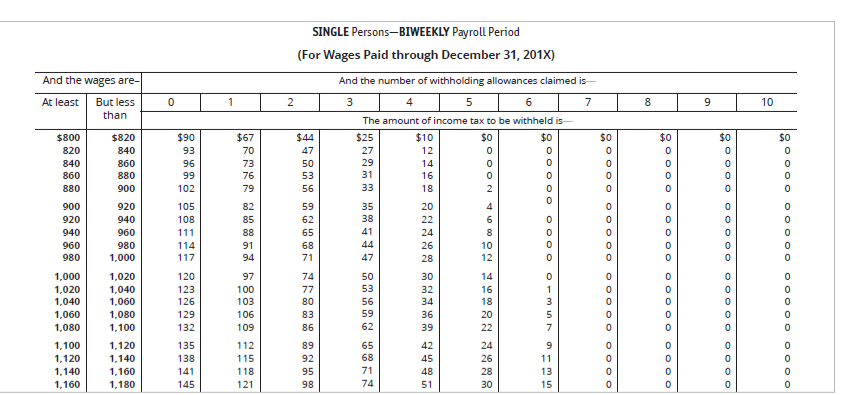

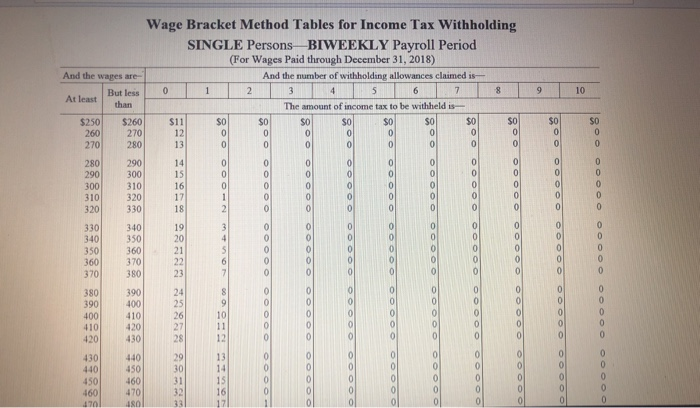

We suggest you lean on your latest tax return to make educated withholding changes. It describes how to figure withholding using the Wage. This publication supplements Pub.

Minnesota Withholding Tax is state income tax you as an employer take out of your employees wages. Withholding Tax Calculator RestrictionsLimitations on the use of BIRs Withholding Tax Calculator The application is not downloadable. Employers can use the calculator rather than manually looking up.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. For example if your biweekly income equals 1900 you would multiply 1900 by 00765 to find you would have 14535 withheld for FICA taxes. 15 Employers Tax Guide and Pub.

That means that your net pay will be 37957 per year or 3163 per month. Payroll So Easy You Can Set It Up Run It Yourself. Ask your employer if they use an automated.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. For employees withholding is the amount of federal income tax withheld from your paycheck. Rates range from 0 to 399.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. The application is simply an automated. To change your tax withholding amount.

Taxes Paid Filed - 100 Guarantee. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Your average tax rate is.

The following table highlights the equivalent biweekly salary for 48-week 50-week 52-week work years. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Calculating Your State Withholding Tax To calculate your State withholding tax find your tax status as shown on your W-4 Form.

Although income taxes on wages are generally. If your effective income tax rate was 25. See the IRSs Withholding Estimator.

For all filers the lowest bracket applies to income up to 25000 and the highest bracket only. Based on the number. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Ad Compare This Years Top 5 Free Payroll Software. The withholding calculator can help you figure the right amount of withholdings.

Computes federal and state tax withholding for. To help determine the number of allowances to claim on your W-4 form. Thats where our paycheck calculator comes in.

You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate.

Solved Wage Bracket Method Tables For Income Tax Withholding Chegg Com

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Payroll Taxes For Employees Startuplift

1 On December 5 201x Prepare A Payroll Register Chegg Com

How To Calculate Federal Income Tax

395 11 Federal State Withholding Taxes

2022 Biweekly Payroll Calendar Template For Small Businesses Hourly Inc

Solved Note Use The Tax Tables To Calculate The Answers To Chegg Com

Solved Compute The Net Pay For Each Employee Using The Chegg Com

Paycheck Calculator Take Home Pay Calculator

Learning Objectives Calculate Gross Pay Employee Payroll Tax Deductions For Federal Income Tax Withholding State Income Tax Withholding Fica Oasdi Ppt Download

How To Calculate Federal Income Tax

How To Calculate Payroll Taxes Methods Examples More

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Calculator Take Home Pay Calculator

Calculating Federal Income Tax Withholding Youtube

Solved Calculate The Amount To Withhold From The Following Chegg Com